As your wealth grows, managing it and aligning it with your objectives becomes more complicated.

At Aspect Partners, we focus on understanding your objectives and your values. We marry them with sophisticated financial theory coupled with pragmatism and common sense. We develop an integrated view of your wealth, and we create customized strategies tailored to your specific needs. We help you clarify your vision for your financial future, and we help you achieve it.

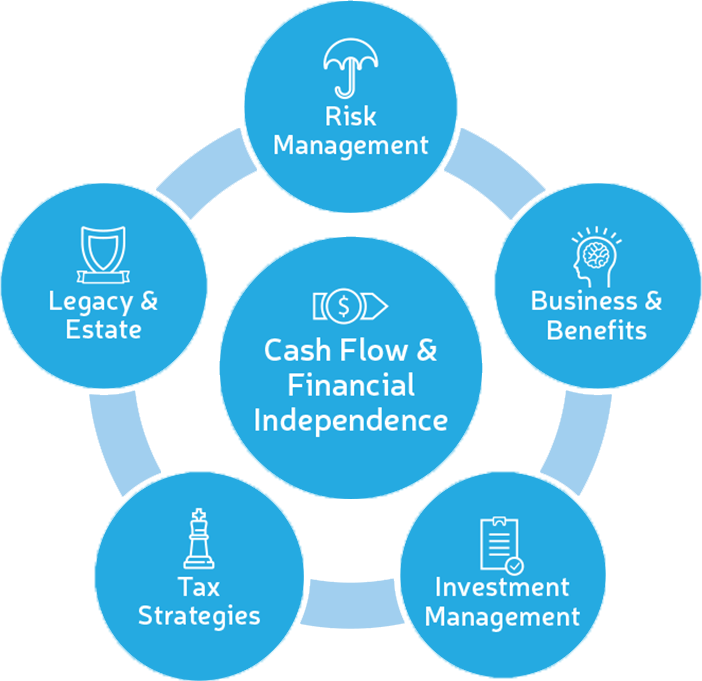

That construct spans all of the financial aspects of your life, and we focus on those that are most important to you:

Financial Independence and Cash Flow Planning

Cash flow is the foundation of the financial planning process and the key determinant of your financial independence. Each person defines financial independence differently; we work with you to establish your vision—and the steps you can take to realize it.

Investment Management

We help you develop an investment strategy tailored to the objectives that are most important to you: retirement, cash flow, education, charitable giving and others. We incorporate several factors, including asset allocation, risk management, tax efficiency and cost.

Legacy and Estate Planning

Our role is to help identify your vision for your legacy, your family, your business and your community, which we translate into the realm of the possible. We develop strategies to efficiently drive your family, business and charitable objectives, and we work with your team of advisors to make sure those plans are executed. We then help ensure that your financial structure incorporates the appropriate legal and tax strategies to drive the maximum benefit to you, your family and the organizations and causes that are most important to you.

Risk Management

Any financial plan should be resilient and durable. To accomplish that, it must identify and efficiently manage risk while also recognizing that often the biggest risks are the ones we don’t foresee. We help clients plan for disaster, disability, survivorship, generational wealth transfer and long-term care, so that when hazard does strike, your plan can absorb it. We work with you and your team of advisors to design a program that meets your specific needs while being as cost effective as possible.

Tax Strategies

Business owners and high-income earners often have opportunities for mitigating their income and estate tax liability. We help identify, analyze and integrate tax planning as part of our overall and ongoing planning process. It’s not just what you make; it’s what you keep that’s important.

Business Owner Planning

We have a particular strength in working with business owners to help them integrate their business objectives with their personal ones. We have a broad range of resources to help clients manage their qualified and non-qualified deferred compensation planning, human capital strategies, entity structure, transition and succession planning and to uniquely integrate those areas with clients’ personal planning and objectives.

GUIDING PRINCIPLES

Understanding where you're trying to go will help us guide you with the technical tools and financial strategies necessary to get there.